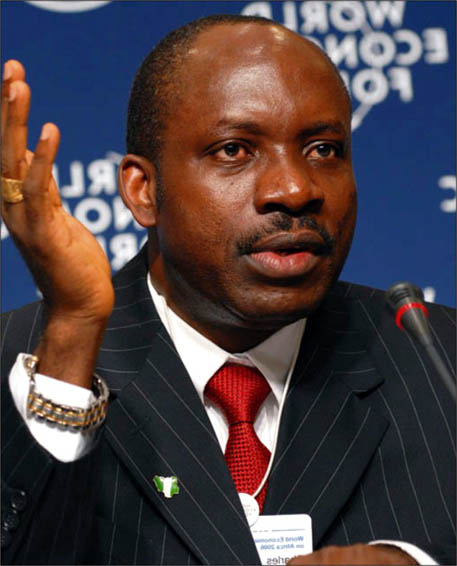

Renowned economist and a former Governor

of the Central Bank of Nigeria, Prof. Chukwuma Soludo, on Sunday alleged

that over N30tn had been stolen under the watch of the Minister of

Finance, Dr. Ngozi Okonjo-Iweala.

of the Central Bank of Nigeria, Prof. Chukwuma Soludo, on Sunday alleged

that over N30tn had been stolen under the watch of the Minister of

Finance, Dr. Ngozi Okonjo-Iweala.

Soludo, in a 10-page response to

Okonjo-Iweala’s rebuttal of his earlier criticism of the management of

the Nigerian economy under the administration of President Goodluck

Jonathan, said the nation was in for a very turbulent time this year

because the economy had been grossly mismanaged.

Okonjo-Iweala’s rebuttal of his earlier criticism of the management of

the Nigerian economy under the administration of President Goodluck

Jonathan, said the nation was in for a very turbulent time this year

because the economy had been grossly mismanaged.

The Federal Government had last Wednesday

described the five-year tenure of Soludo as the governor of the CBN

between 2004 and 2009 as a disaster to the banking sector.

described the five-year tenure of Soludo as the governor of the CBN

between 2004 and 2009 as a disaster to the banking sector.

The comment came on the heels of an

earlier article by Soludo last Monday in which he claimed that the

Nigerian economy under Jonathan had performed woefully.

earlier article by Soludo last Monday in which he claimed that the

Nigerian economy under Jonathan had performed woefully.

Okonjo-Iweala had in a statement on Wednesday described Soludo’s as an “embittered loser in the Nigerian political space.”

But Soludo, in his new article, which was

made available on Sunday, said if the prices of crude oil in the

international market failed to rebound, Nigeria would face an

unprecedented level of economic crisis with horrible attendant hardships

for the citizenry.

made available on Sunday, said if the prices of crude oil in the

international market failed to rebound, Nigeria would face an

unprecedented level of economic crisis with horrible attendant hardships

for the citizenry.

“Our public finance is haemorrhaging to

the point that estimated over N30tn is missing, or stolen, or

unaccounted for, or simply mismanaged,” the former CBN governor

stressed.

the point that estimated over N30tn is missing, or stolen, or

unaccounted for, or simply mismanaged,” the former CBN governor

stressed.

In the piece entitled, ‘Ngozi

Okonjo-Iweala and the missing trillions’, Soludo said the sharp decline

in the naira-dollar exchange rate from 158 a few months ago to 215

currently showed that trouble was already at the doorstep.

Okonjo-Iweala and the missing trillions’, Soludo said the sharp decline

in the naira-dollar exchange rate from 158 a few months ago to 215

currently showed that trouble was already at the doorstep.

He added that “unless oil price recovers,

this is just the beginning,” adding, “For the sake of Nigeria, I won’t

keep quiet anymore!”

this is just the beginning,” adding, “For the sake of Nigeria, I won’t

keep quiet anymore!”

The former CBN boss said his earlier

article was written out of concern that the 2015 election campaigns were

being conducted in a manner that did not show that the economy was in a

crisis.

article was written out of concern that the 2015 election campaigns were

being conducted in a manner that did not show that the economy was in a

crisis.

“Part of my frustration is that five

years after, everything I warned about has come to happen and we are

conducting our campaigns as if we are not in a crisis. As a concerned

Nigerian, I have a duty to speak out again,” he said.

years after, everything I warned about has come to happen and we are

conducting our campaigns as if we are not in a crisis. As a concerned

Nigerian, I have a duty to speak out again,” he said.

Soludo, who gave the details of the N30tn

allegedly stolen under Okonjo-Iweala’s watch, said, “Under you as the

Minister of Finance and coordinator of the economy, the basket of our

national treasury is leaking profusely from all sides. Just a few

illustrations! First, you admit that ‘oil theft’ has reduced oil output

from the average 2.3 – 2.4 million barrels per day to 1.95 mpd (meaning

that at least 350,000 to 450,000 barrels per day are being ‘stolen’). On

the average of 400,000 per day and the oil prices over the past four

years, it comes to about $60bn ‘stolen’ in just four years.

allegedly stolen under Okonjo-Iweala’s watch, said, “Under you as the

Minister of Finance and coordinator of the economy, the basket of our

national treasury is leaking profusely from all sides. Just a few

illustrations! First, you admit that ‘oil theft’ has reduced oil output

from the average 2.3 – 2.4 million barrels per day to 1.95 mpd (meaning

that at least 350,000 to 450,000 barrels per day are being ‘stolen’). On

the average of 400,000 per day and the oil prices over the past four

years, it comes to about $60bn ‘stolen’ in just four years.

“In today’s exchange rate, that is about

N12.6tn. This is at a time of cessation of crisis in the Niger Delta and

the amnesty programme. Can you tell Nigerians how much the amnesty

programme costs, and also the annual cost for ‘protecting’ the pipelines

and security of oil wells? And the ‘thieves’ are spirits?

N12.6tn. This is at a time of cessation of crisis in the Niger Delta and

the amnesty programme. Can you tell Nigerians how much the amnesty

programme costs, and also the annual cost for ‘protecting’ the pipelines

and security of oil wells? And the ‘thieves’ are spirits?

“Second, my earlier article stated that

the minimum forex reserves should have been at least $90bn by now and

you did not challenge it. Rather, it is about $30bn, meaning that gross

mismanagement has denied the country some $60bn or another N12.6tn. Now,

add the ‘missing’ $20bn from the NNPC. You promised a forensic audit

report ‘soon’, and more than a year later, the report itself is still

‘missing’. This is over N4tn, and we don’t know how much more has

‘missed’ since Sanusi cried out.

the minimum forex reserves should have been at least $90bn by now and

you did not challenge it. Rather, it is about $30bn, meaning that gross

mismanagement has denied the country some $60bn or another N12.6tn. Now,

add the ‘missing’ $20bn from the NNPC. You promised a forensic audit

report ‘soon’, and more than a year later, the report itself is still

‘missing’. This is over N4tn, and we don’t know how much more has

‘missed’ since Sanusi cried out.

“How many trillions of naira were paid

for oil subsidy (unappropriated?). How many trillions (in actual fact)

have been ‘lost’ through customs duty waivers over the last four years?

As coordinator of the economy, can you tell Nigerians why the price of

Automotive Gas Oil, popularly called diesel, has still not come down

despite the crash in global crude oil prices, and how much is being

appropriated by friends in the process?

for oil subsidy (unappropriated?). How many trillions (in actual fact)

have been ‘lost’ through customs duty waivers over the last four years?

As coordinator of the economy, can you tell Nigerians why the price of

Automotive Gas Oil, popularly called diesel, has still not come down

despite the crash in global crude oil prices, and how much is being

appropriated by friends in the process?

“Be honest: Do you really know (as

coordinator and minister of finance) how many trillions of naira self-

financing government agencies earn and spend? I have a long list but let

me wait for now. I do not want to talk about other ‘black pots’ that

impinge on national security.”

coordinator and minister of finance) how many trillions of naira self-

financing government agencies earn and spend? I have a long list but let

me wait for now. I do not want to talk about other ‘black pots’ that

impinge on national security.”

Soludo added, “My estimate, Madam, is

that probably more than N30tn has either been stolen, or lost, or

unaccounted for, or simply mismanaged under your watchful eyes in the

past four years. Since you claimed to be in charge, Nigerians are right

to ask you to account. Think about what this amount could mean for the

112 million poor Nigerians, or for our schools, hospitals, roads, etc.

that probably more than N30tn has either been stolen, or lost, or

unaccounted for, or simply mismanaged under your watchful eyes in the

past four years. Since you claimed to be in charge, Nigerians are right

to ask you to account. Think about what this amount could mean for the

112 million poor Nigerians, or for our schools, hospitals, roads, etc.

“Soon, you will start asking the citizens

to pay this or that tax, while some faceless ‘thieves’ are pocketing

over $40m per day from oil alone.”

to pay this or that tax, while some faceless ‘thieves’ are pocketing

over $40m per day from oil alone.”

The former CBN governor also maintained

that the banking sector consolidation exercise that he supervised was a

huge success contrary to Okonjo-Iweala’s assertion that it failed

woefully.

that the banking sector consolidation exercise that he supervised was a

huge success contrary to Okonjo-Iweala’s assertion that it failed

woefully.

He described it as both “a revolution and a war, and most people thought it was impossible, but thank God we succeeded. “

Soludo said, “For the first time in

Nigeria’s history, a policy of that magnitude was announced and the

deadline kept with precision. We were courageous to revoke the licences

of 14 banks, including those of my friends, in one day. The FT-Banker

concluded that the scale, precision and cost of the transformation were

unprecedented in the world. Before then, Malaysia had the least cost of

banking consolidation at five per cent of the Malaysian GDP.

Nigeria’s history, a policy of that magnitude was announced and the

deadline kept with precision. We were courageous to revoke the licences

of 14 banks, including those of my friends, in one day. The FT-Banker

concluded that the scale, precision and cost of the transformation were

unprecedented in the world. Before then, Malaysia had the least cost of

banking consolidation at five per cent of the Malaysian GDP.

“It did not cost Nigerian taxpayers one

penny. Twenty-five new and stronger banks emerged, but the powerful idea

behind the consolidation ignited something even more powerful – the

race to the top. Banks raised more capital, and even banks like First

Bank, Zenith, GTB, etc. that did not merge with others went on capital

raising several times. The consequence was higher levels of

capitalisation and within two years, 14 Nigerian banks were in the top

1,000 banks in the world and two in the top 300 (no Nigerian bank was in

the top 1,000 before I came).

penny. Twenty-five new and stronger banks emerged, but the powerful idea

behind the consolidation ignited something even more powerful – the

race to the top. Banks raised more capital, and even banks like First

Bank, Zenith, GTB, etc. that did not merge with others went on capital

raising several times. The consequence was higher levels of

capitalisation and within two years, 14 Nigerian banks were in the top

1,000 banks in the world and two in the top 300 (no Nigerian bank was in

the top 1,000 before I came).

“Even after I left office, still nine

banks were in the top 1,000. Our vision was to have a Nigerian bank in

the top 100 banks within 10 years. As I see the new Access Bank, Zenith,

GTB, Fidelity, Diamond, UBA, FBN, FCMB, Skye, Stanbic IBTC, Union,

Ecobank, etc., I cannot but feel that we have taken giant steps forward.

banks were in the top 1,000. Our vision was to have a Nigerian bank in

the top 100 banks within 10 years. As I see the new Access Bank, Zenith,

GTB, Fidelity, Diamond, UBA, FBN, FCMB, Skye, Stanbic IBTC, Union,

Ecobank, etc., I cannot but feel that we have taken giant steps forward.

“Deposits and credit soared (from barely

N1.2tn to over N7tn); new technologies (ATM and e-banking) boomed, and

banks had 57,000 new jobs; mega businesses emerged (ask any major

operator in the Nigerian economy their experience with banking and

credit before and after Soludo; – the Dangotes, Arik, MM2, oil and gas

operators etc.); capital market boomed and dominated by the banking

sector.

N1.2tn to over N7tn); new technologies (ATM and e-banking) boomed, and

banks had 57,000 new jobs; mega businesses emerged (ask any major

operator in the Nigerian economy their experience with banking and

credit before and after Soludo; – the Dangotes, Arik, MM2, oil and gas

operators etc.); capital market boomed and dominated by the banking

sector.

“It was a new dawn for the Nigerian

private sector. I have heard Dangote twice say that he would not be near

as big as he is today without the banking consolidation. Many other

stakeholders still say it today. FDI and portfolio inflows flooded into

Nigeria. The world celebrated, and one single transformative idea has

changed the face of the private sector and the economy forever. Banks

became Nigeria’s first transnational corporations, with about 37

branches outside of Nigeria.”

private sector. I have heard Dangote twice say that he would not be near

as big as he is today without the banking consolidation. Many other

stakeholders still say it today. FDI and portfolio inflows flooded into

Nigeria. The world celebrated, and one single transformative idea has

changed the face of the private sector and the economy forever. Banks

became Nigeria’s first transnational corporations, with about 37

branches outside of Nigeria.”

He also said he would write about the Assets Management Corporation of Nigeria later as a separate topic.