Ethiopia Targets $7.5 billion by Privatizing Its Economy

The government targets $7.5 billion to boost it’s economy to deal with dwindling exports and growing foreign debt.

For decades, Irba Jana has scraped out a modest living from sugar cane, selling his harvest to mills run by Ethiopia’s state-owned sugar monopoly. But lately he’s been working as a security guard to supplement his income, as two of the three nearby processing facilities have closed because of a lack of upkeep and investment. “Sugar cane just isn’t profitable anymore,” says Irba, a grizzled, 50-year-old father of eight. “It may be time to start farming something else.”

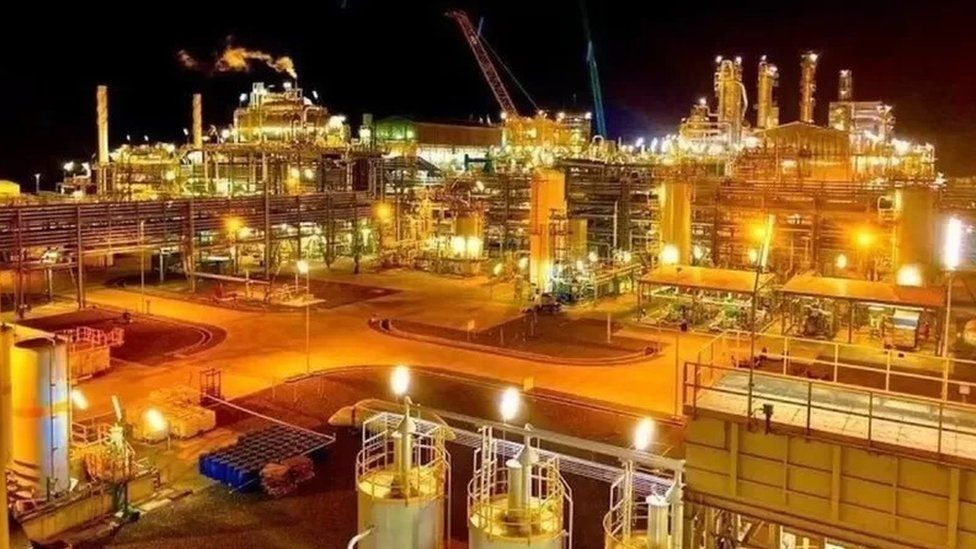

Recently, though, he got news that could augur a return to better times: The government is planning to privatize Ethiopian Sugar Corp.’s assets, including a factory complex near Irba’s home on a high plateau a two-hour drive southeast of Addis Ababa. And a local investor aims to let farmers buy shares in the mills, with promises of investment in additional projects such as candy and ethanol factories. A voice at the factory would benefit farmers, says Beyene Bikila, a fellow grower and union member. “We know how to produce,” he says, “and we should get paid properly.”

Privatization of the sugar industry is part of a sweeping liberalization backed by Abiy Ahmed, the 43-year-old prime minister who in October won the Nobel Peace Prize for his work to end a two-decade conflict with neighboring Eritrea. Ethiopia is among Africa’s most dynamic economies, averaging annual growth of almost 10% for the past decade. Yet the country remains one of the most state-controlled on the continent, a legacy of the Marxist-Leninist Derg regime that ruled from the 1974 coup that deposed Emperor Haile Selassie until a return to democracy in 1991. “The private sector is not playing its natural role,” says Eyob Tekalign, a former diplomat and private equity executive hired by Abiy as state minister for finance. “Our growth had shortcomings in terms of quality, job creation, inclusivity, and benefiting the poor.”

The government aims to raise at least $7.5 billion from selling assets from the sugar industry, the phone system, railroads, and other infrastructure. Ethiopia needs foreign exchange: Exports have dwindled, and external debt has grown 26% since 2016, to $27 billion—more than a quarter of the country’s likely 2020 gross domestic product of roughly $100 billion. In December, the International Monetary Fund and the World Bank pledged more than $5 billion to help narrow the budget deficit and support Abiy’s reform agenda. Saudi Arabia and the United Arab Emirates have also pledged cash, and China has pushed back the repayment of loans by a decade, to 2030.