Stocks Tumble After China Retaliates With High Tariff

Stocks fell sharply Monday, giving back the gains from a strong turnaround in the previous session, after China decided to raise tariffs on some U.S. goods as the ongoing trade war between the world’s largest economies intensified.

The Dow was down 700 points, while a steep drop in the tech sector pushed the S&P 500 down by 2.7%. The Nasdaq dropped 3.5%.

China will hike tariffs on $60 billion worth of U.S. imports, starting on June 1. The goods targeted include a broad range of agricultural products. This comes after President Donald Trump raised tariffs on Chinese imports last week. China said in a statement that the U.S.′ decision jeopardized the interests of both countries and does not meet the “general expectations of the international community,” according to a Google translation.

Trade bellwether Caterpillar fell 5%, while Apple dropped 5.2%. Boeing shares declined more than 3% amid speculation the airplane maker could be singled out by China in the trade war.

Asian markets fell broadly. The Nikkei 225 index declined 0.7% Monday while the Shanghai Composite pulled back 1.2%. European stocks also dropped. The Stoxx 600 index fell 1.1% while the German Dax dipped 1.3%.

“Volatility is going to persist. People don’t know what to make of it,” said JJ Kinahan, chief market strategist at TD Ameritrade. But “this is more of a re-evaluation of stocks than it is a pure panic. Bonds have rallied over the last couple of weeks, but if this was a panic you’d see people coming a lot more for bonds.”

The benchmark 10-year Treasury yield fell to 2.4% on Monday while the 2-year rate dipped to 2.18%. The Cboe Volatility index, which is considered to be the best fear gauge in the stock market, rose 4.7 points to 20.72.

Trump tweeted that China will be “hurt very badly if you don’t make a trade deal, ” noting that companies would be forced to leave the country without an agreement. Trump also said that China had a “great deal” almost completed but they “backed out.”

U.S. equities fell sharply last week after Trump threatened to hike tariffs on China. Trump followed through on his threat, raising levies from 10% to 25% on $200 billion worth of Chinese goods. The S&P 500 and Nasdaq fell 2.2% and 3% last week, respectively, their worst weekly performances since December. The Dow had its worst week since March, dropping 2.1%.

“The market was bracing for a really big event and last week we got it,” said James Masserio, head of equity derivatives trading in the Americas at Societe Generale. He noted investors had been loading up on downside protection ahead of last week’s move. After Monday’s news, however, we could see volatility being bid up “even higher.”

Some of those losses were mitigated on Friday after stocks staged a massive comeback, however. Sentiment was boosted by Trump in a Friday afternoon Twitter post that the latest round of trade talks with China’s delegation — which concluded after tariffs had already been increased — had been “candid and constructive.”

“No one wins from a trade war, although China stands to lose more,” said Chen Zhao, chief global strategist at Alpine Macro, in a note to clients. “Trump’s objective is to get a good deal from China, and as such the new tariffs announced last week may simply be a pressure tactic forcing Beijing to accept American demands. For China, the economic cost of losing the American market is simply too high.”

“The odds of a China-U.S. trade accord remain significant, even though tariffs are being raised,” he added.

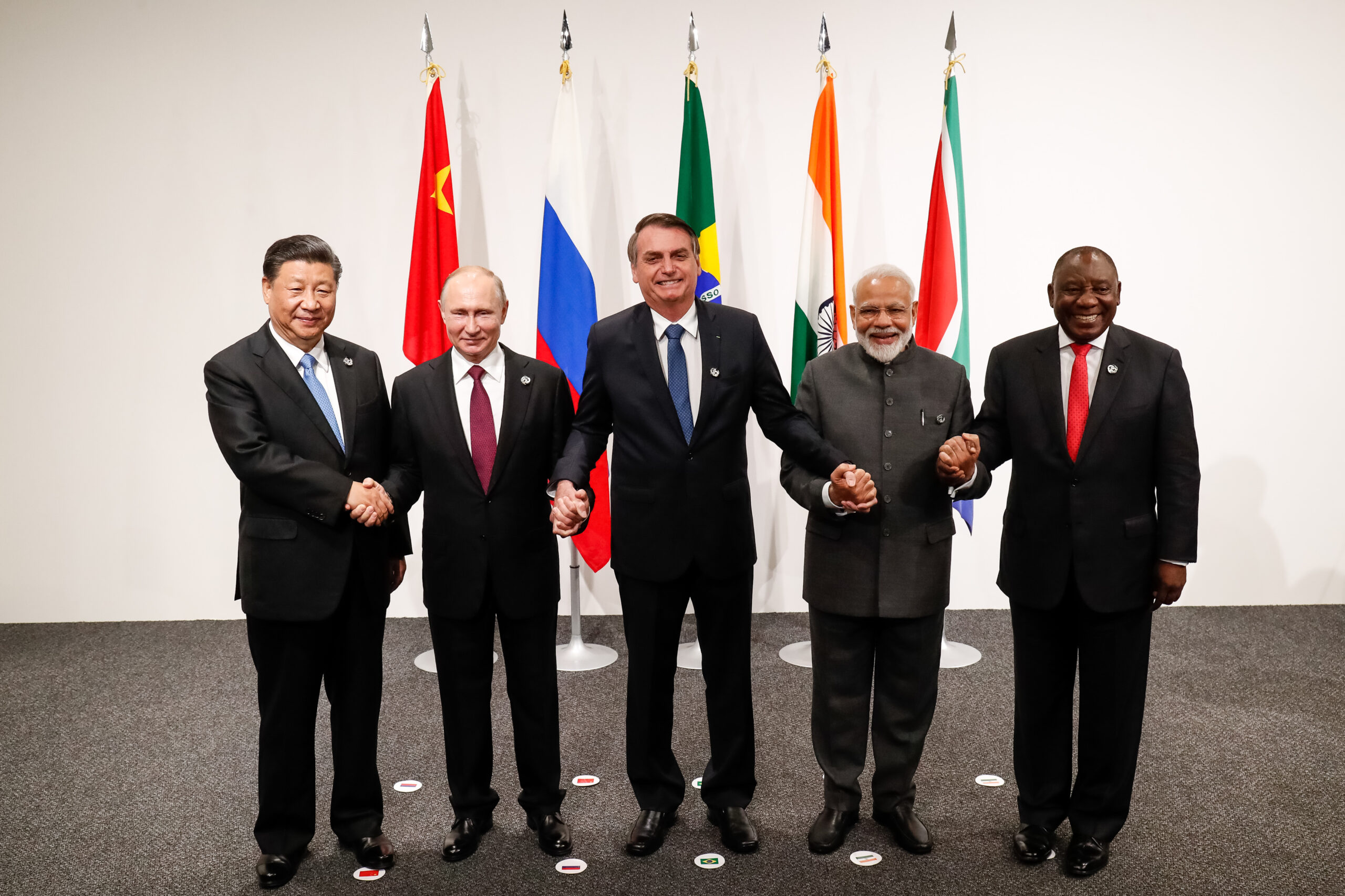

Despite the tension between the world’s two largest economies, White House economic advisor Larry Kudlow said Sunday that Trump and Chinese President Xi Jinping are likely to meet at the June G-20 summit in Japan. Kudlow said the chances of such as meeting “were pretty good” but added that there are “no concrete, definite plans” for when U.S. and Chinese negotiators will meet again.

About Author

Discover more from BillionBill

Subscribe to get the latest posts sent to your email.