The principal membership between Credit card giant Visa and cryptocurrency company Coinbase, makes Coinbase the first cryptocurrency company to issue debit cards for others, including other cryptocurrency companies and more traditional firms alike.

Visa confirmed it granted Coinbase the principal membership, clarifying that the company itself won’t actually accept cryptocurrency when the project goes live later this year.

While Coinbase says it’s not planning on issuing cards to others anytime soon, the principal membership status marks a potentially important new revenue stream for the company, which Forbes estimates saw a 40% decline in earnings last year. By simplifying the process of spending cryptocurrency anywhere Visa is accepted, the membership also lays the foundation for a potential explosion of bitcoin, ether, XRP and more as a way to buy everyday items, regardless of whether the merchant itself accepts cryptocurrency.

“Your Bitcoin holdings have never been liquid because you have to sell them, you have to go through a process, withdraw the money, and then spend it. It’s never been an instant, “Oh, I’ll buy this cup of coffee with bitcoin,” says Zeeshan Feroz, CEO of Coinbase UK, which received the membership. “What the card is trying to change is the mindset that crypto is tucked away, takes two days to access, and can actually now be spent in real time.”

Managed by Coinbase’s fully-owned U.K subsidiary, based in London with offices in Dublin, the card that automates the conversion of cryptocurrency into whatever currency the merchant accepts will be available in 29 countries when it is first issued later this year, including Denmark, Estonia, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, and the U.K. The Coinbase Visa debit card will not be available to U.S. residents.

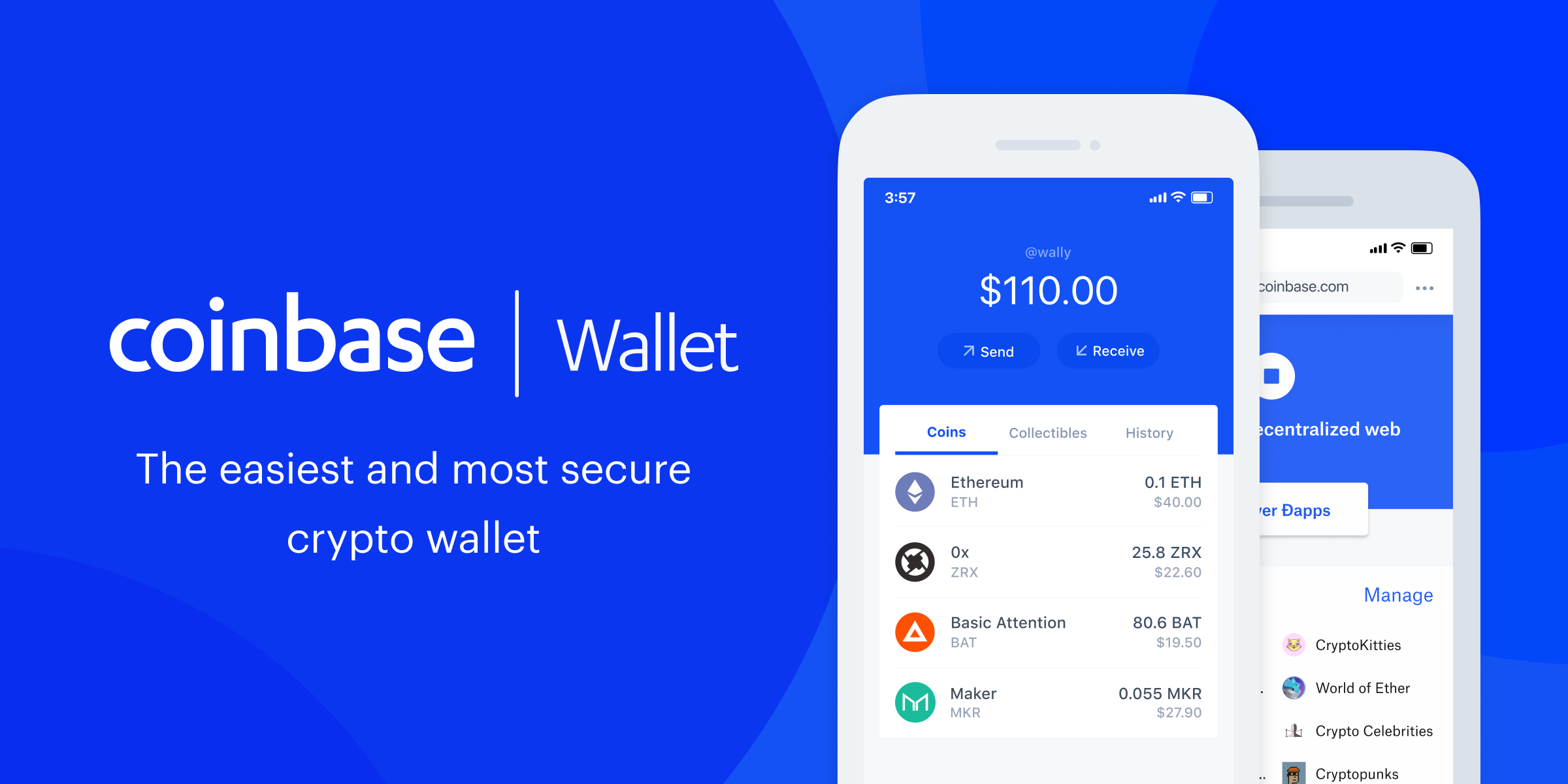

Further simplifying the process of actually spending cryptocurrency, the nine cryptocurrencies available on the card, also including litecoin, bitcoin cash, Brave’s BAT, Augur’s REP, 0x’s ZRX, and Stellar’s lumen, won’t likely be subject to unwieldy capital gains taxes at the point of sale. Unlike the U.S., the E.U doesn’t require spenders pay additional tax on the difference in price based on when a cryptocurrency was purchased, and when it was spent.

Feroz says direct access to the Visa network gives the cryptocurrency exchange more flexibility in the business models it pursues. A previous Coinbase Visa card was issued in April 2019 by financial services firm Paysafe Group Holdings Limited, which vets its customers, including corporate spending firm Soldo and mobile banking app Lunar, and charges a fee for the service.

“You have a dependency on their risk appetite and the models they’d like to work with,” says Feroz. “Direct membership allows us to take control of our issuing program.”

About Author

Discover more from BillionBill

Subscribe to get the latest posts sent to your email.