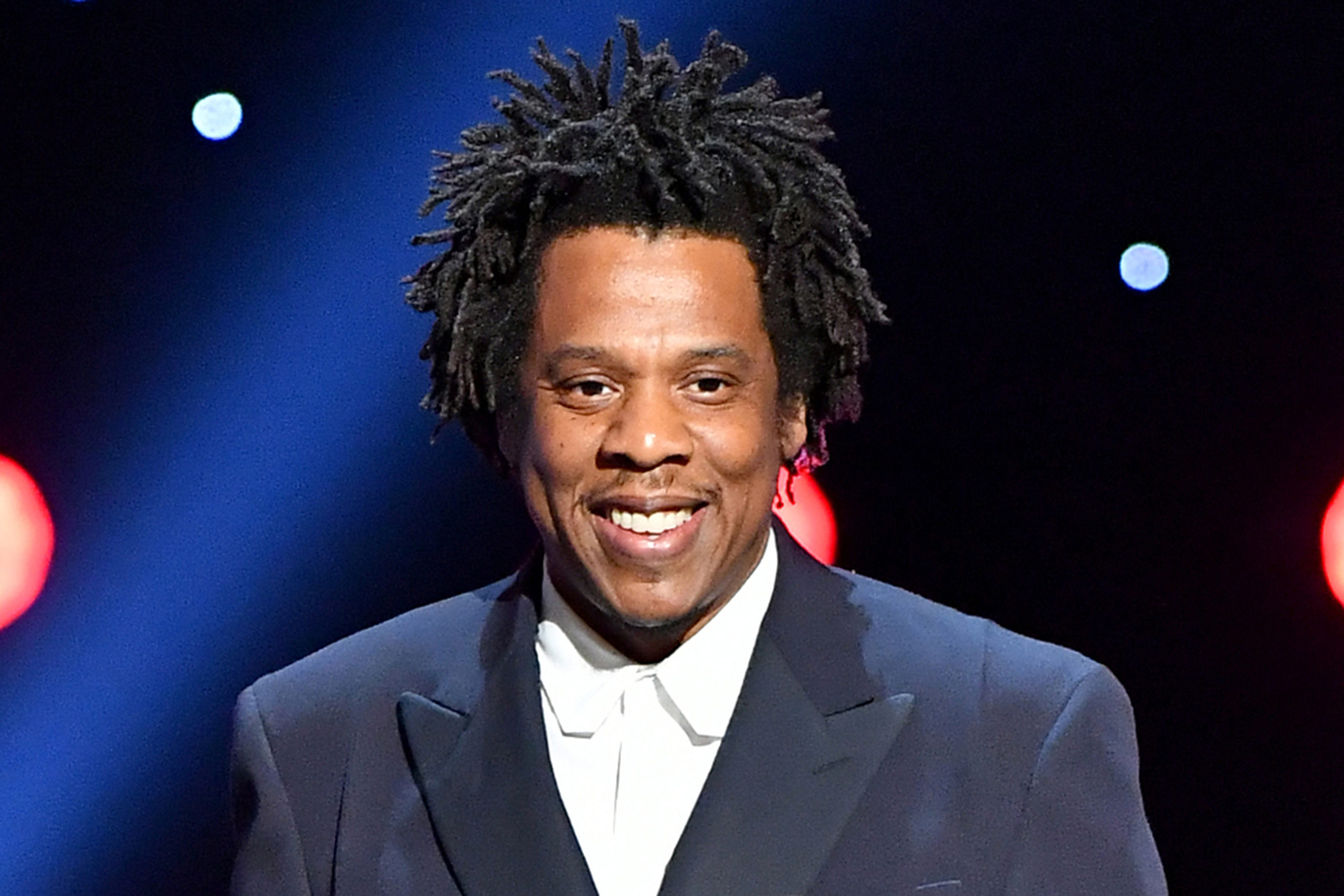

Jay Z Raises $54 million To Invest In Startups

Jay-Z’s Marcy Venture Partners has raised an $85 million fund to invest in consumer-focused startups, according to a recently released SEC filing.

The paperwork confirms that Jay-Z’s venture outfit, established in 2018, is based in San Francisco and includes three general partners: Jay-Z, his longtime colleague Jay Brown and venture capital veteran Larry Marcus. Aside from the size of the fund, the only new information is its tally of investors, a robust 54, indicating wide support for the billionaire’s vision. Crunchbase lists e-bike purveyor Wheels, chef service Hungry and Rihanna’s Savage X Fenty lingerie line among Marcy’s investments. A representative for the billionaire did not immediately reply to a request for comment.

The news underscores how serious Jay-Z is about venture capital, following in the footsteps of Ashton Kutcher, the premier entertainer-investor. The actor landed on our cover in 2016 after turning a $30 million fund into a quarter-billion in just six years thanks to early investments in startups like Uber, Airbnb and Spotify. Kutcher and business partner Guy Oseary, who manages U2 and Madonna, then landed $100 million from Liberty Media to launch another fund, and more recently they raised $150 million from separate investors for yet another.

As Jay-Z and his colleagues chase Kutcher-esque scale, the billionaire has secured his status among the other elite athletes and entertainers who’ve been increasingly eschewing traditional endorsements in favor of equity deals, including Kevin Durant, Serena Williams and Justin Bieber.

“It’s not always [just] money you bring to the table,” hip-hop star and Queensbridge Venture Partners cofounder Nas told me in an interview for my book A-List Angels: How a Band of Artists, Actors and Athletes Hacked Silicon Valley, pointing out that stars often provide valuable connections and exposure for fledgling companies.

Nas, once a bitter rival of Jay-Z in the battle for New York hip-hop supremacy, now fights for deal flow—as opposed to lyrical bragging rights—with his erstwhile foe. Indeed, hip-hop has spawned some of the most prolific investors at the intersection of entertainment and venture capital. In addition to Nas and Jay-Z, other startup-savvy names include Diddy, 50 Cent, Snoop Dogg and even Chamillionaire.

The trend has boosted individual moguls but also serves as an inspiration to a section of society that’s been historically cut off from ownership opportunities. It’s hard to ignore the symbolism of Jay-Z and Nas, both of whom named their venture outfits after the housing projects in which they grew up, becoming serious venture capitalists.

“It’s bigger than hip-hop,” superproducer Swizz Beatz explained last year when Forbes first declared Jay-Z a billionaire. “It’s the blueprint for our culture. A guy that looks like us, sounds like us, loves us, made it to something that we always felt that was above us.”