US Central Bank Eyeing Digital Dollar to Counter BRICS Pay

The US Central Bank is reportedly eyeing the creation of a digital dollar as the BRICS economic alliance unveiled its BRICS Pay system. Indeed, Federal Reserve official Michael Barr discussed the status of a Central Bank digital currency (CBDC) and the Fed’s potential recommendation to the US Central Bank.

Specifically, Barr has noted that no recommendation has been made. However, he also discussed the need for the agency to continue “learning from both domestic and international experimentation” to aid in the eventual decision. Moreover, the BRICS economic alliance has noted two massive developments in the area of digital finance.

US Set to Consider the Digital Dollar Amid BRICS Advancements

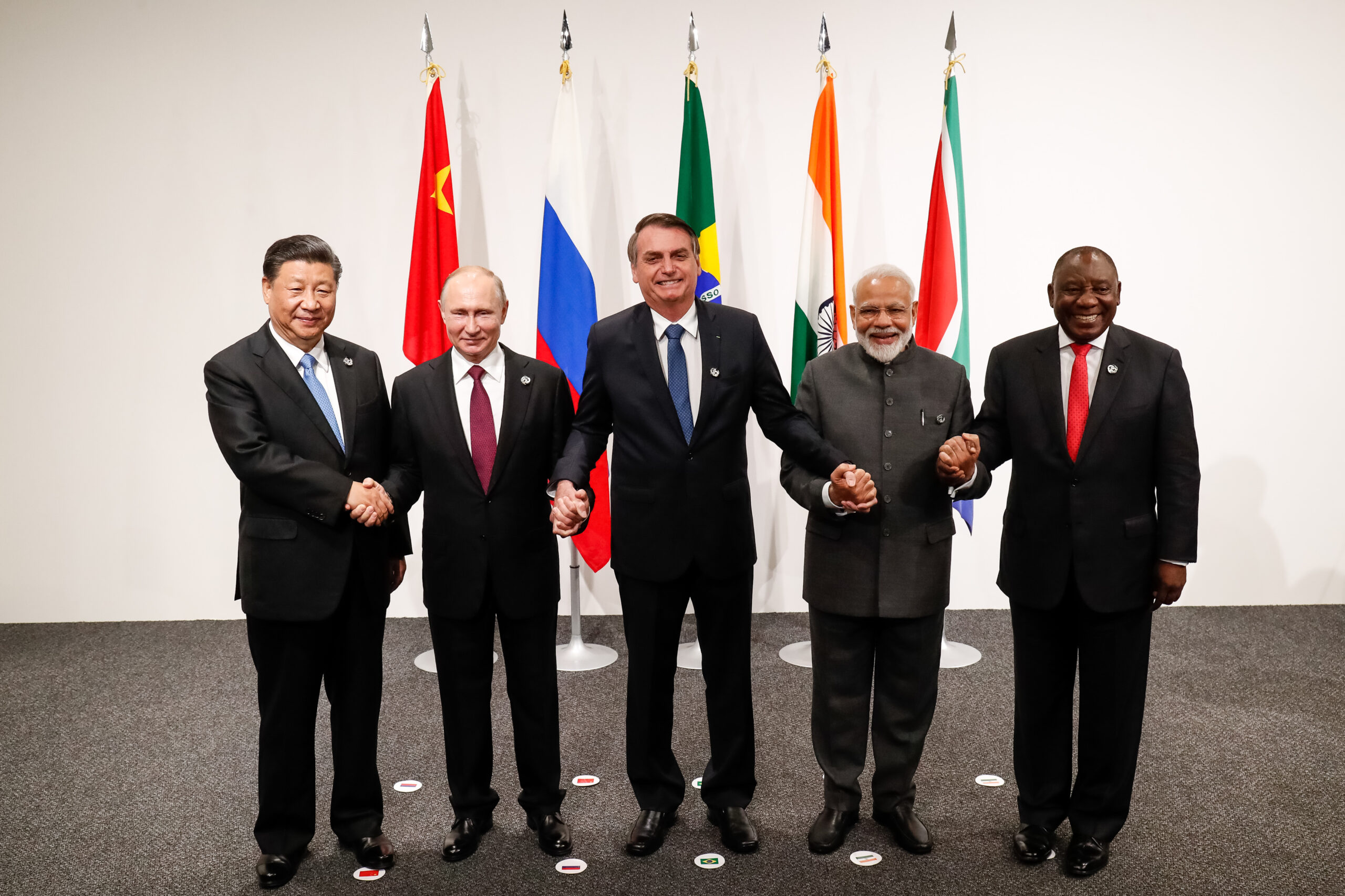

The year has been a prominent one for the BRICS economic alliance, as it has experienced impressive growth. Despite the six-country expansion it agreed to during its 2023 summit, it has also greatly expanded its influence. Subsequently, its multipolar hopes have seemingly found renewed international fervor.

Now, the US Central Bank is eyeing the creation of a digital dollar amid the arrival of BRICS Pay. Specifically, Federal Reserve official Michael Barr discussed the development and the Fed’s recommendation. Moreover, he discussed the value of learning from whom the technology is rapidly advancing.

“Learning from both the domestic and international experimentation can aid decision-makers in understanding how we can best support responsible innovation that safeguards the safety and efficiency of the US payments system,” Barr stated. Additionally, he noted that the agencies continue to gather results from “domestic and international initiatives on CBDCs” in his remarks.

The arrival of BRICS Pay coincides with the recent landmark oil deal that was settled in the digital yuan. Indeed, it has brought forth a clear avenue in which the economic alliance can potentially outmaneuver the United States. Therefore, it is reinforcing its multipolar efforts and lessening international reliance on the US dollar. Especially amid the growing utilization of blockchain technology in global economics.