FTX Sues ByBit For ‘VIP’ Withdrawals Nearing $1 billion Before Collapse

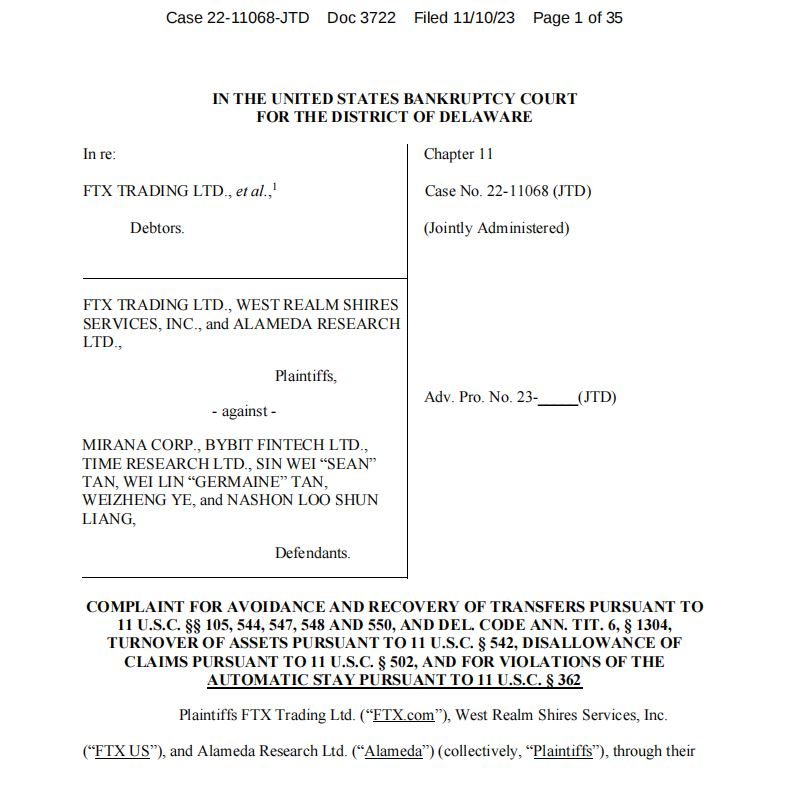

The FTX bankruptcy estate has filed a lawsuit against cryptocurrency exchange ByBit. The lawsuit seeks to recover nearly $1 billion worth of assets allegedly withdrawn prior to FTX’s collapse.

The suit, filed by FTX CEO John J. Ray III, claims ByBit leveraged “VIP” access and connections to withdraw significant funds and digital assets from its investment arm, Mirana Ventures, along with two other affiliated entities, Time Research and ByBit executives.

FTX employees reportedly kept a spreadsheet for withdrawal tracking

According to the lawsuit, FTX employees kept a spreadsheet tracking withdrawal requests from VIP customers. This includes Mirana, and prioritized processing their transactions as FTX faced a liquidity crunch in November 2022. This resulted in over $327 million being transferred to Mirana from FTX.

In total, the value of assets withdrawn by ByBit and associated parties from FTX is estimated at close to $1 billion.

The lawsuit alleges ByBit has since imposed restrictions on the FTX bankruptcy estate, preventing withdrawals exceeding $125 million from ByBit’s platform. ByBit is allegedly using the locked FTX assets as leverage to recover $20 million it failed to withdraw before FTX’s collapse.

Separately, the legal action claims the exchange misled FTX in 2021 by stating the decentralized organization BitDAO was community-run when in fact ByBit controlled it.

BitDAO later rebranded to Mantle and launched a new MNT token. When FTX began converting its BIT to MNT tokens, Mantle allegedly disabled FTX’s account and initiated a “community vote” to block the conversion.

FTX contends ByBit’s actions violate the automatic stay enacted during its Chapter 11 bankruptcy proceedings. The lawsuit seeks compensatory and punitive damages related to both the frozen assets and the BIT/MNT token scheme.